Retention and profitability.

These two words have played second fiddle to “sales” and “growth” for over a decade and a half.

I’ve sat in countless board meetings where 90% of the meeting was spent on sales performance, leaving precious little time to discuss updates on strategy, customer retention, people, and other “less sexy” matters.

But the last several board meetings have been different, and my peers in the Gain Grow Retain community share similar experiences.

Now is the time for for every company’s customer success strategy to shine.

Owners are realizing that our best chance for a great year relies on maintaining current business, driving growth from existing customers, continuing to sell new logo business where possible, and doing all of the above… profitably.

The era of growth at all costs is over.

At least for now.

Why is this happening?

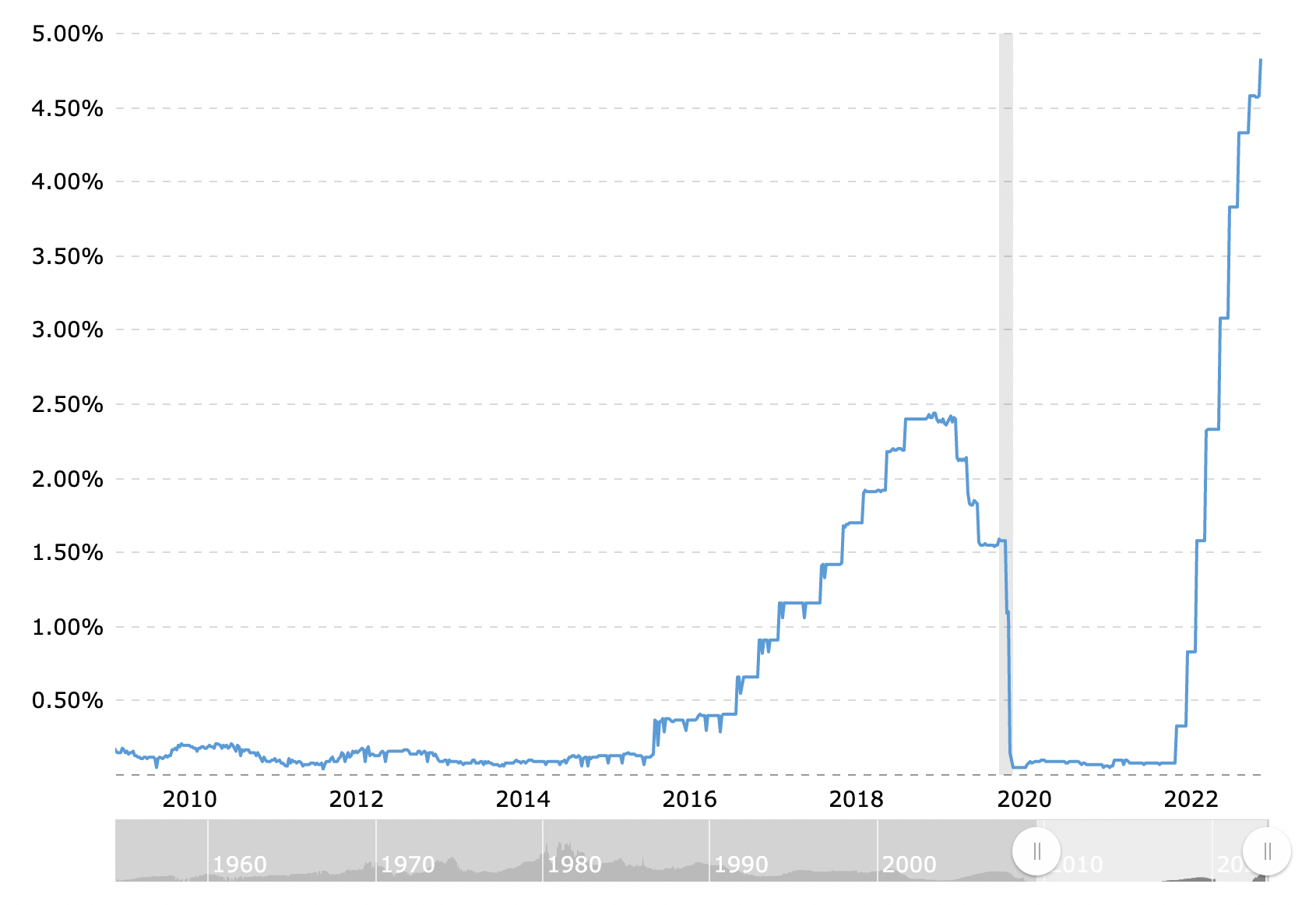

In large part it’s because of interest rates.

Rising interest rates impact everything from customer purchasing power to employment costs to interest payments on corporate debt used to leverage investors.

Since 2009, the cost of capital has been nearly zero in the United States, making it ubiquitous and helping to drive corporate valuations through the roof ahead of realized results.

These valuations attracted more investment in additional growth which drove additional spending. A vicious cycle indeed, but not atypical for our industry.

Federal Funds Rates since 2009 – https://macrotrends.com

Software businesses are notoriously capital-intensive. They require highly skilled individuals across engineering, product design, marketing, sales, finance, customer success, and human resources. Most firms also invest in perks, office space, and other benefits to attract the best and brightest talent.

Underneath all these benefits are very real costs. In most software businesses, 75% or more of costs are directly related to the employment of people.

To make matters worse, subscription and consumption revenue models mean companies capture revenue over time vs. all at once and up-front (hence the mission-critical nature of retention and customer expansion).

SaaS companies are inherently upside-down from a profit and loss perspective until they reach a semblance of scale, which is why most require hefty cash injections from angel, venture, and private equity investors who bet on sustained growth.

But when growth slows and the cost of capital increases, it’s like a game of musical chairs. When the music stops, some of the players find themselves sitting on the floor.

This is why we’ve seen a rash of layoffs in the past year. Companies are cutting the costs they can control to maximize their cash runways, and even profitable companies are cutting where they overestimated growth.

Businesses have a duty to provide operating margin growth to their shareholders, especially when top-line growth stalls.

This means almost everyone is reducing staff in some form or fashion; RIFs, canceling new initiatives, surgical reductions, holding off hiring open positions, choosing not to backfill attrition, etc.

It turns out that tech is not immune to the fundamental laws of business. Eventually, value creation involves generating profits or at least not spending more cash than it brings in from business operations.

In this environment, customer success leaders are well-positioned to become the business leaders their companies need – scrutinizing the ROI of current investments and finding new ways to scale.

What initiatives are you undertaking this year to help your company win in this environment?

💡 Weekly Favorites

Here are some of my favorite podcasts, blogs, and videos from the week (all about writing):

Although our society is imperfect, it’s created the conditions for unparalleled prosperity. Check out the most recent episode of No Mercy, No Malice on The Prof G Podcast with Scott Galloway, one of my current favorites 🔥.Starbuck’s new CEO will work one shift per month in a Starbucks store. The ultimate, frontline listening tour for an executive. Three reasons the banking crisis isn’t a repeat of 2008 (from the perspective of a banker).

See you next week. ✌️