Since the financial crisis of 2008-09, we have enjoyed a time of peace and prosperity in the tech sector.

Although COVID caused a blip in 2020, that short period of uncertainty gave way to one of the largest market run-ups in history.

As a result of unbridled growth, many companies loosened constraints on spending as they pursued growth at all costs.

I don’t recall a time in my career when companies spent money so freely than over the past decade.

They procured dozens of (disparate) SaaS products. Hired employees beyond what was needed to build, sell, and deliver products to customers. And in an effort to retain top talent, provided those employees with over-the-top benefits and perks.

In 2023, we find ourselves in the midst of a tech recession.

All types of technology buyers, from businesses to consumers, are tightening their belts.

We can see the impact by examining both public and private SaaS/cloud company metrics (the private ones via a slew of recent PE/VC benchmark reports like the one below).

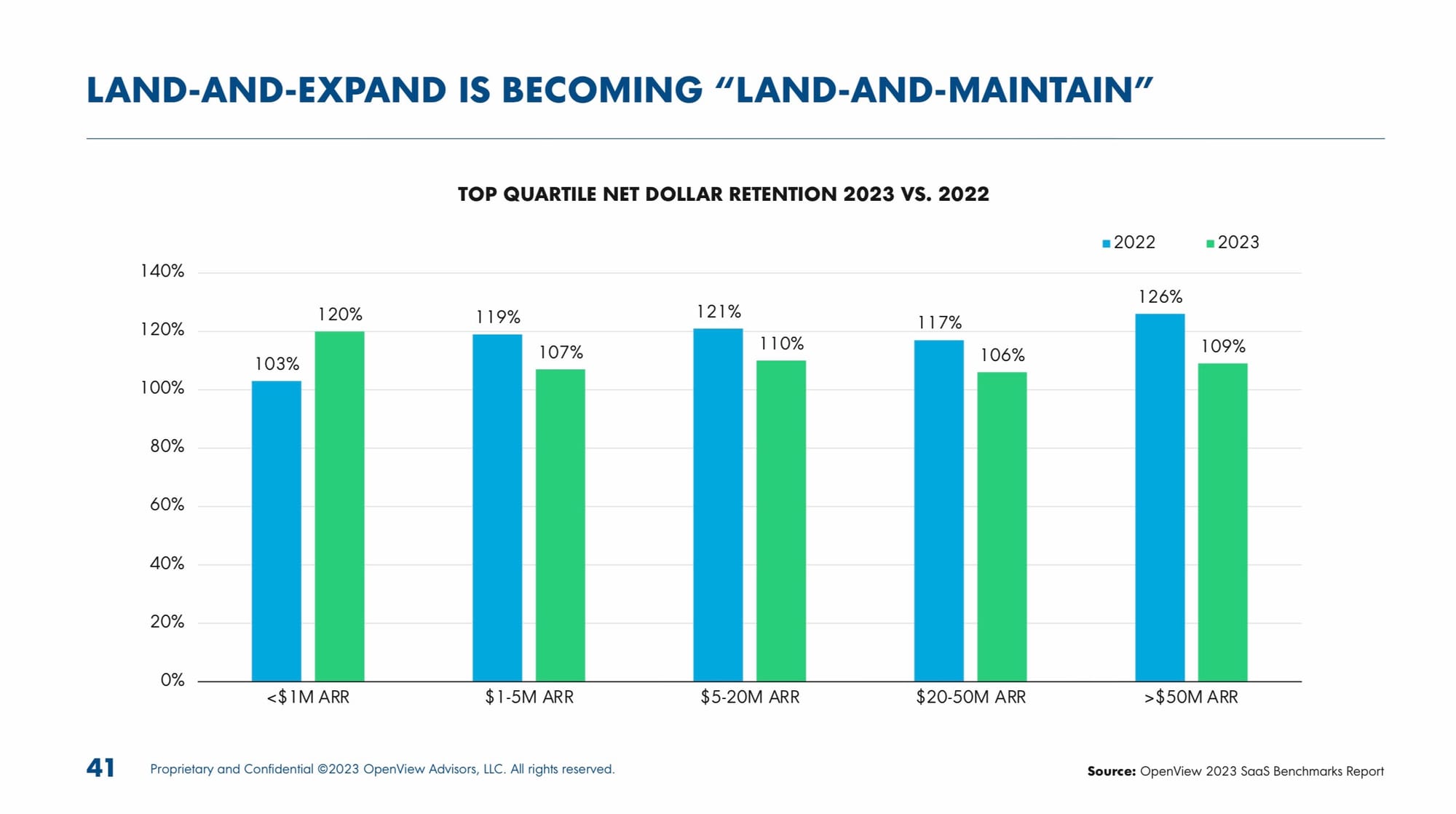

Credit: OpenView

OpenView (RIP) recently published a benchmark showing that net retention dropped over ten percentage points from 2022 to 2023 across nearly all early-stage, private SaaS segments.

Whether we realized it then or not, we all became wartime leaders in Q4 of 2022.

2023 will go on record as being one of the toughest new logo bookings years on record for software companies.

As we head into 2024, there are three areas where Chief Customer Officers can make a difference on these outcomes.

They need to…

get serious about revenue.proactively manage costs.lean into customer relationships.

Executing well across these three areas will help their companies live to prosper another day. And with any luck, bolster their careers.

Let’s look at each one.

Getting serious about revenue.

The most fundamental job of a customer success executive is to drive gross retention, i.e., keep as much of the revenue from your current customers as possible.

The industry benchmark for “good” gross retention is 90% or higher.

Renewal rate is a leading indicator to gross retention, but renewals are also a precarious time for vendors. At renewal, customers know they have a chance to renegotiate vendor relationships.

And renegotiate, they will.

Procurement teams have more power than we’ve seen in 15 years.

Given carte blanche by the CFO, procurement teams are like possies of henchmen looking to pick a fight with every vendor come renewal time.

It’s a buyer’s market, and in most cases, procurement has the upper hand. Their companies pay them to reduce vendor costs. They have zero fear when it comes to dropping relationships, even longstanding ones, that don’t yield significant results for the business.

To combat this, CCOs need to lead out on renewal offer design.

Good renewal offers accomplish two goals. They provide options for the customer to tradeoff what’s valuable to them (e.g., commitment length, payment terms, scope, price increases, and total spend), and they establish guardrails and boundaries on what the vendor can or will agree to.

It’s wise to predesign offers to reduce stress on renewal teams and prevent ad-hoc discounts or unnatural concessions that don’t align with the needs of the business.

For the CCO, the other key revenue mandate is customer revenue expansion.

Whether or not they own the expansion bookings number directly, the CCO should also take ownership of this target and drive it. Even if sales is responsible for closing expansion opportunities.

The CCO must work closely with the CRO to operationalize renewal and expansion motions. They can accomplish this by allocating specialist teams for renewal and expansion, deploying commercial methodologies such as MEDDICC, and by driving a cadence of accountability around renewal and expansion pipelines — just like sales does for new business.

I’m seeing more CCOs report to CROs. I believe it’s because CROs bring discipline to revenue pipeline management. CCOs will do themselves a favor by leaning into their operational skill set and quickly learning to drive retention and expansion opportunity creation and conversion processes.

Proactively manage costs.

On the expense side of the P&L, we’re playing a different game today than we were 18 months ago.

It’s up to every executive in the business to run their team as lean as possible.

Headcount makes up 75-80% of the costs of a SaaS company. Wartime leaders maintain and grow revenue while spending the fewest possible dollars to do so.

That’s just how business works.

I realize I sound like a broken record on this subject, but for customer-facing teams, this isn’t about cost-cutting our way to success.

It’s about changing the way your teams work with customers.

The most profound mindset shift a company can make is adopting scaled, one-to-many programs that are meant to connect and engage all stakeholders: employees, customers, and partners.

These programs won’t replace all of the one-on-one CSM, services, support, account manager, etc. touch points. However, scaled programs enable these touch points to be more strategic and valuable while reducing the demand on customer-facing teams.

Lean into relationships.

Finally, wartime CCOs lean into relationships. Having executive connections with customers is critical to supporting frontline customer success teams.

In most SaaS companies, 5-10% of customers make up 60-80% of ARR. (Pareto’s principle in plain sight).

Engaging with executive sponsors at just the top 10% of customers can influence a significant portion of total ARR.

I’ve used my CEOs, CFOs, COOs, CPOs, and even the CTO and CHRO as executive sponsors. It spreads the workload and arms the executive team with helpful customer insights. Executive sponsor relationships also provide needed air cover and triangulation with frontline teams.

When executives take the time to connect with customers, it speaks volumes about the company’s commitment to customers and the market.

If all of this sounds like a lot of work, that’s because it is. For those willing to step up, wartime execution galvanizes great leaders.

The best CCOs from the post-Covid era will be remembered for driving revenue, maintaining low-cost structures, and building long-term relationships in the markets they serve.

2024 is the CCO’s time to shine.

Where will you place your focus?

🤘