I’ve been on the road for seven out of the past eight weeks.

Mostly at conferences where I’ve gotten to catch up with friends, former colleagues, and acquaintances.

The number one question I’ve asked my peers is, “How’s business?”

To a person, the answer is the same, “It’s been a tough year.”

The pain is palpable, but it’s not without explanation.

During the 1995 NFL football season, legendary quarterback Brett Favre, popped 14 Vicodin before each game to overcome pain from injuries and to get himself onto the football field.

In a similar fashion, the technology industry has been on a private capital-fueled bender since 2009 when recovery from the 2008 mortgage debacle began.

Interest rates have snapped up over the past 18 months. Even though they remain well below 40+ year norms the money isn’t free anymore.

The rapid change shocked an industry bloated on cheap capital (or “inexpensive,” as my mom would say).

Prior to the rate hikes, private investors regularly took risk (and gains) off the table by recapitalizing their investments with debt. As a result, many tech companies are now saddled with variable-rate bank loans whose rising interest payments eat into cash flows and operating margins.

Even profitable companies must show bottom-line growth to offset slower top-line revenue growth (see the Rule of 40 to explain why this is).

Hence the layoffs and renewed scrutiny of spending.

To make matters worse, new sales have slowed, and churn rates have risen. Go-to-market efficiency relative to Net ARR Growth has plummeted across every technology industry sector.

It’s a perfect storm, and the gig is up.

Like Brett Favre, companies are checking into rehab. They need to get clean and back in shape to fight another day.

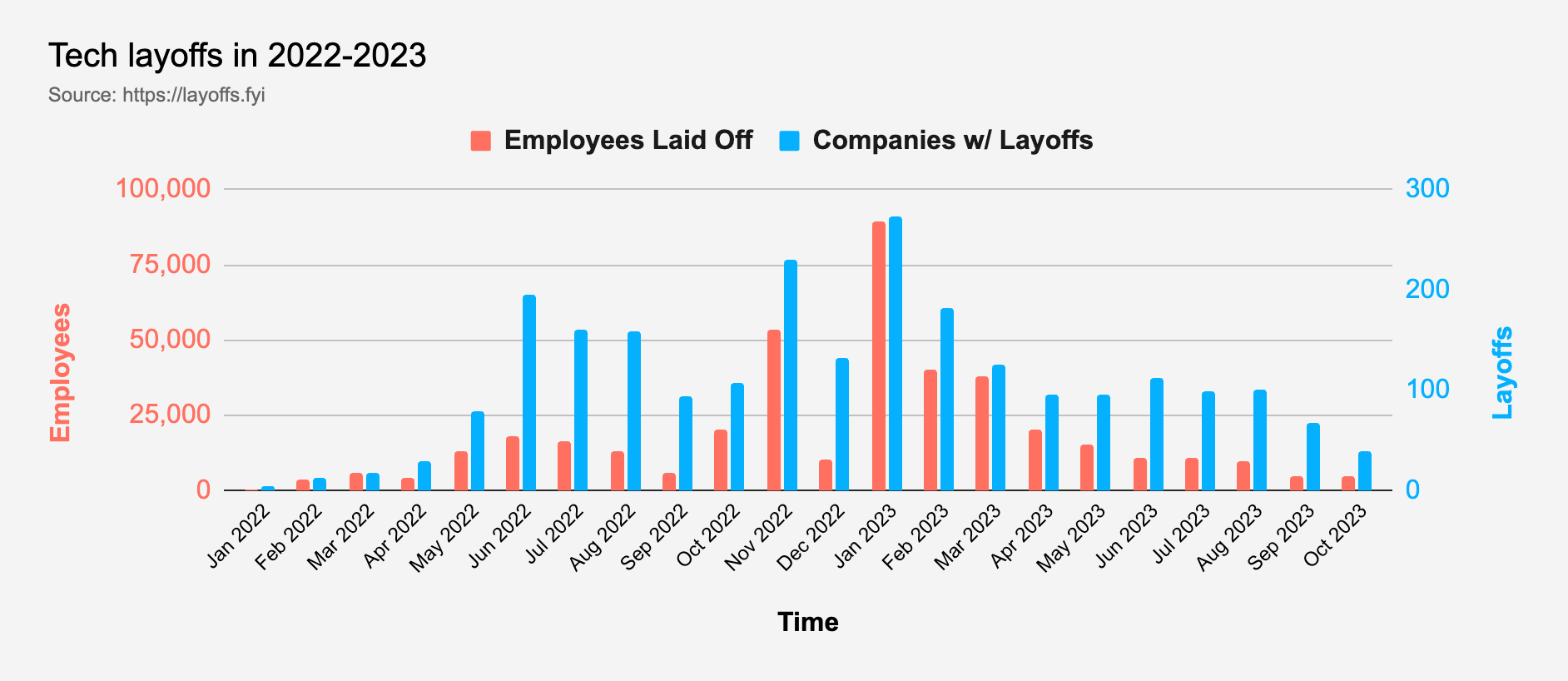

Layoffs are one indicator of where we are in the rehabilitation process. The good news is that they have steadily declined since peaking in January:

credit: layoffs.fyi

Once we’re through rehab, there will be a new set of expectations for executives and operators:

Go-to-market efficiency must increase – marketing, sales, and customer success must achieve more with fewer headcount, tools, and resources. They will need to scale instead of growing linearly with customers and sales targets. Procurement will drive efficiency in outside spending – anyone in sales knows this is already happening at the direction of corporate CFOs, even in smaller companies. Procurement is calling the shots, and we must enable our business champions to defend us at the point of sale and renewal. Product development will be scrutinized – no more building that one-off feature to save a single customer and no more pet projects for the executive team. We will judge the success of product development efforts by return on invested capital relative to Net ARR Growth on a year-over-year basis.

These are things that good businesses already do. Companies that combine customer-centric innovation with these disciplined behaviors will dominate in their fields.

It’s time to get clean. And as more companies do, my optimism for the future of our industry grows.

Tech will continue to shape the world and make life on this planet better. But only if we do it sustainably.

As you look to 2024, how are you and your team embracing this brave new world?

🤘🎸